GTB succeeded because it focused on intangibles – Opeyemi Agbaje

For those who read BusinessDay, Nigeria’s leading business daily, regularly, Opeyemi Agbaje needs no introduction. For regular viewers of ChannelsTV, he doesn’t need one either. Agbaje is a leading financial and policy analyst in Nigeria. In this exclusive interview with Suraj Oyewale, Jarushub’s editor, he bares his mind on issues ranging from his career journey to his personal life. It’s never been published anywhere before. Enjoy:

JH: Opeyemi Agbaje is a familiar name in economic and political punditry in Nigeria, can you give me a brief insight into your background?

My parents, both of them of loving and blessed memory, Solomon Babatunde Agbaje and Margaret Ojuolape Agbaje were teachers and retired as Principal and Head Teacher respectively. My father was also a political leader in Remo, Ogun State and served as Chairman of Ogun State Central Schools Board and Local Government Service Commission under the old UPN between 1979 and 1983.

I attended Igbobi College Yaba and University of Ife, graduating in Law in 1985 and called to the Bar in 1986. I later earned an LLM at University of Lagos and MBA from IESE Business School, Spain.

I practiced Law for a season in the DPP’s Office in old Bendel State Ministry of Justice and at Kola Awodein (SAN) and Co before joining the banking sector and working in several banks-First Bank of Nigeria Plc, GTBank where I stayed the longest, Oceanic and Metropolitan Bank. I left the industry voluntarily as an Executive Director in 2004 just before Soludo’s popular consolidation exercise to start my consulting firm, RTC Advisory Service Ltd and also took a faculty position at Lagos Business School teaching two courses-Business Strategy and Social, Political and Economic Environment of Business. I had actually taught in the Business School on a part-time basis since 1999 even while in banking and I left the full time faculty in 2007 to concentrate on my growing consulting practice.

JH: You read law in Ife, but went ahead to become a banker, and later financial and management consultant, why this change in career path?

I had decided from childhood (probably from age 5) that I was going to be a lawyer. But then from my third year in university, I started getting fascinated with economics, finance, management and the corporate world generally. This fascination may have come from my avid and consistent readership of Time and Newsweek magazines and later Businessweek and similar publications.

Later those ones became rather elementary for me and I switched to The Economist and I have read every copy of that publication since maybe 1992 or 1993. Anyway by the time I was applying to do my masters at University of Lagos Law faculty in 1988, I was clear in my mind that I wanted to work in the corporate sector and selected my courses accordingly-Company Law, International Economic Law, Secured Credit Transactions and Constitutional Law.

I was lucky to get a job in the old First Bank through a gentleman called Alhaji Shehu Muhammed then Executive Director who had a child in my late mother’s school, Corona School, Victoria-Island and moved to GTB when banking deregulation made those opportunities available.

JH: Do you go to court?

Today I don’t – not because I don’t want to, but because I don’t have the time. I prosecuted criminal cases during my NYSC at the DPP’s Office and I did extensive court appearances, civil litigation and solicitors work with Kola Awodein (SAN). As a strategist and consultant however, I know the value of focus and my “centre of gravity” since I left banking has been my strategy, policy and economic consultancy. However I have a law firm, LEGAL XRAYS and without chasing legal work, I do anything that comes that doesn’t require court appearances. I don’t rule out going to court in future, but not now.

JH: You have maintained a column with BusinessDay newspaper for at least 7 years now, what inspires your super-regular writings? Have you ever missed a week’s column?

It is interesting you ask that question. Most people are probably unaware that I don’t get any payment for writing that newspaper column. I chose not to receive any emoluments when I negotiated the column with Businessday because I wanted to keep my motives pure. I write because I want to influence positive change in Nigeria based on my values and principles. That is my motivation. I know myself and I suspect if I was paid, I would have lost my zeal for that enterprise. Quite frankly, beyond meeting my needs and those of my family, money does not motivate me and neither does vain ambition. I want to impact this society for good and one day I want to go to my God with a clear conscience, that I tried my best to change Nigeria. Most people would not know this, but my example and model in this regard was late Chief Gani Fawehinmi who I never met personally, but who always inspired me with his lifelong commitment to changing Nigeria using his skills and competences as a lawyer. I realized that the most effective way I can affect this society is to deploy my oral and written communication skills in that direction.

I have missed an occasional column, especially in recent times, but generally I have so much agitating me about Nigeria that I write most weeks.

JH: Are you thinking of putting your past column essays into a book?

I have enough material for several books! Actually that is another motivation for me. As I write the column every week, I know I have written another chapter in another book! I have many of the book themes and titles in my head and I just need a time out to put them together and get them published. The challenge is finding that time out! I am so busy with my consulting, writing the columns and doing public commentary on radio, TV and other news media, producing and hosting my TV show, “The Policy Council”, communicating on social media and honouring my fiduciary obligations to the Boards of Chemical and Allied Products Plc, Lagos State Security Trust Fund and Convention on Business Integrity/The Integrity Organisation Ltd/Gte as well as other private and family obligations. I am praying that God will open up some space for me to get those books published!

JH: As a regular reader of your column, I think I am familiar with most of your writings and opinions on issues. I recall you initially endorsed Mr. Lamido Sanusi’s appointment as Governor of Nigeria’s apex bank, but you later turned out to be one of his biggest critics. What is your assessment of the 4 years tenure of the Kano prince?

I knew SLS long before he became CBN Governor and we were united by our shared commitment as professionals with a social conscience who had interest in the polity beyond how much our banking jobs could pay us. He was a friend and associate, and I admired his courage and intellectual pursuits though not his occasional inclination to religious and ethnic radicalism. By the time he was appointed CBN Governor, I had become quite critical of ethical and professional standards within the industry (as well as the industry’s general lack of a socio-economic and developmental purpose) and quite frankly that was part of why I left the industry.

As a follower of my newspaper column, you’re probably aware that I had written “Reflections on Nigerian Banking” Parts 1, 2 and 3 before Sanusi’s appointment where I called attention to the ills in the sector and the problems that were likely to arise in future. You can google those articles. Indeed I make bold to assert that I was probably the ONLY analyst and commentator that was publicly raising that alarm while others were endorsing the scandalous public offers and practices in some of these banks. I was happy at Sanusi’s appointment and knowing him, I felt he had an opportunity and the inclination to clean up the system and I supported his early actions. However I believe he subsequently began to overreach and I made my reservations known to him at first privately and then in my column.

But I still have friendly personal relations with him and I evaluate his policies and actions on merit. For instance I strongly supported his “cashless Lagos” policy on TV and in my column while I opposed his approach to implementation of Islamic banking. I understand the case based on financial inclusion for non-interest banking, but I believe that could be achieved in a manner consistent with BOFIA and our Constitution. Generally I also felt the banking crisis could have been more carefully managed to prevent systemic side-effects, especially the credit crunch and loss of jobs that ensued and I said so to him right from the very beginning. I also have concerns about the fiscal aspects of AMCON but I think the CBN has done well with monetary policy and financial sector risk management.

JH: As a veteran economic analyst, do you see Nigeria achieving its potential of becoming one of the world’s biggest economies within the next one decade?

Nigeria has huge economic potentials as the whole world now recognizes, but we have continuously sub-optimised. In the last two years, for example we pre-occupied ourselves with a completely man-made distraction-“Boko Haram” (and “Fulani herdsmen”) and 2015 politics is already threatening to increase political risk and complicate political scenarios. Our economy is managed for the benefit of the elite and not the majority and inequality is pervasive. We have allowed poverty and unemployment to deny the vast majority of our people the benefits of modern society and our politics is by-and-large dysfunctional.

I in fact question this focus on growing GDP alone and in my view the central purpose of economic management should now be to reduce poverty to below 10%; reduce unemployment below 5%; improve human capital through education, health and skills acquisition; and to create a prosperous middle class with modern housing and infrastructure. Only then will growth be sustainable. Having said that GDP rebasing and 6-7% GDP growth will probably make us the biggest economy in Africa sooner or later and if power sector privatization is successfully completed and ongoing agricultural and other reforms are sustained, GDP growth rates may in fact get a boost. So our GDP size objectives are not unattainable.

JH: You were one of the earliest set of staff of GTB and rose to become an AGM before leaving the bank. GTB is today widely regarded as a model of business success in a stormy financial terrain like ours. What do you think GTB did/does differently? How do you feel being one of the brains behind this institution in its early years?

I am proud of the work we did in GTB and the institution we built. I joined the bank at inception in 1990 as a banking officer and left in July/August 1999 as an Assistant General Manager so it was also a rewarding time. GTB focused on the intangibles-vision, values, customer service, bonding, team work, loyalty, integrity, knowledge, professionalism etc. as well as hard work-intense hard work! I am personally proud of my contribution towards the building of that institution in its consumer banking, financial institutions, corporate banking and Ikeja Branch and my role in the visioning exercises, customer service initiatives and strategy formulation throughout my stay in the bank. I was also a Trustee of the Bank’s Staff Investment Trust. I believe the culture of learning and resourcefulness that I left the bank with has helped me as I built my personal economy and reputation afterwards.

JH: What advice do you have for young Nigerian professionals of today?

They should focus on learning and integrity in the first decade of their career development, rather than on pay. I know that may sound idealistic or even unrealistic, but it’s the truth. Learning and integrity will pay you for life, while salary is temporary and consumable. Investing in your skills and competences is the best way of building an enduring career irrespective of time and space. Young professionals should never work in a place that doesn’t allow you build skills, competences, depth of knowledge and reputation no matter how much they are offering to pay you!

JH: Final shot: Apart from writing and reading, do you engage in social or other extra-professional activities? How do you unwind?

I love music, all types of music-juju, rhythm and blues, disco, blues, old school, reggae, country, jazz, Naija, rap, gospel etc. For me music is an important way of de-stressing, relaxing and achieving rest, peace and joy. I also like sports; I was a keen footballer throughout school and I also ran middle distance athletics – 800 and 1,500 metres. I enjoy watching sports. I still walk and jog as often as I can and have a gym in my house.

I have an extensive personal library and perhaps my greatest personal indulgence is books. I hope one day to endow a public library with my collection of books and I read a lot basically around strategy and management, economics and finance, politics and public policy, law, foreign affairs and geo-politics, Christian theology and history. I also love biographies.

In spite of my public activities, I am a private person and I like the private company of my family and friends and I invest a lot of time and resources in my three children who are young adults currently in advanced stages of their education.

Finally I am a child of God and I believe his love, protection and mercy sustains me so I worship him privately and in Church.

Other interviews:

Dr. Farooq Kperogi, respected grammar columnist and university don

Professor Pius Adesanmi, respected columnist and public intellectual

Segun Adeniyi, ex-Media Adviser to late President Umaru Yar’adua

Established in March 2013, JarusHub is a Nigerian information hub with focus on career and management. It is rated Nigeria's most authoritative destination for online career resources. It parades an array of Nigerian professionals who share their career experiences with a view to bridging career information gap and mentoring a generation to success. Whether you're a student, a recent graduate or an established professional, or even an executive, you will always find something to learn on JarusHub. All enquiries to jarushub@gmail.com or 0808 540 4500. Facebook: www.facebook.com/jarushub; Twitter: @jarushub or @mcjarus.

Career Q&A with Jarus: Oil & gas career, poor CGPA

September 17, 2023What is Career Counselling? How to choose the Right Career?

October 24, 2022

8 comments

Let us have your say by leaving a comment belowCancel reply

Recommended For You

-

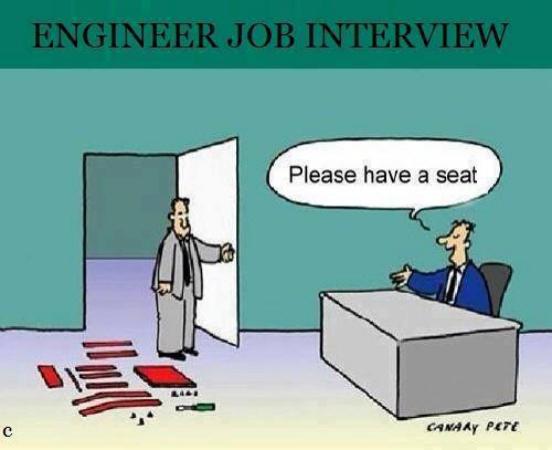

HOW TO DO WELL IN ENGINEERING JOB INTERVIEWS

November 7, 2014 -

COMPANY REVIEW: GRANT THORNTON NIGERIA

April 27, 2018 -

5 ways to make the best use of your time at NYSC camp

November 3, 2016

[…] Opeyemi Agbaje – leading financial expert and former Executive Director, Metropolitan Bank […]

[…] Opeyemi Agbaje – leading financial expert and former Executive Director, Metropolitan Bank […]

[…] Opeyemi Agbaje – leading financial expert and former Executive Director, Metropolitan Bank […]

[…] Mr. Opeyemi Agbaje, CEO, Resources & Trust and respected newspaper […]

[…] Mr. Opeyemi Agbaje, CEO, Resources & Trust and respected newspaper […]

[…] Opeyemi Agbaje – leading financial expert and former Executive Director, Metropolitan Bank […]

[…] Opeyemi Agbaje – leading financial expert and former Executive Director, Metropolitan Bank […]

Quite interesting