4 TIPS TO SURVIVING HARSH ECONOMIC CONDITIONS

Akinsiku Hellen

Hellen is a Tech-savvy and seasoned Communications Expert with extensive knowledge of media production (both traditional and online media), messaging, communications and dissemination techniques.

With great flair for writing, her most powerful weapon is a pen because it allows her to express herself and draft her ideas. She has published over 350 articles on the web spanning across but not limited to various scopes like travel, food, health, business, fashion and relationships. You can visit her personal website at helenamag.com to see some articles she has published.

How to Survive in the Nigeria Today

Many in Nigeria are affected by the present economy. The prices of commodities are climbing yet salaries and wages remain stagnant.

It is important for Nigerians to develop some habits discussed in this article so they can cope with the current situation till things get better.

Below are some ways to reduce spending so you can survive and avoid running into debt.

One, map out your financial plans

Many find themselves in a financial mess because of the failure to draft out a proper spending plan. If you have a clear vision of what you want to achieve financially, what you want to spend and what you want to save, it is easier to maintain a particular budget and not get carried away by unnecessary spending.

Two, learn to save

No matter what you earn, be sure to dedicate a particular percentage to normal savings, as well as an emergency fund that you can fall back on in case of sudden events like loss of job.

Three, go out less

Most people spend a fortune on going out, watching movies at cinemas, hanging out with friends and buying impulsively. Steer clear of friends or female folks that only drag you out to spend lavishly. Learn to say no to them. If you can find ways to limit the way you go out, you will be saving yourself a great deal of money.

Four, be budget conscious

You can as well map out a financial plan but not stick to it. Learn to Leave Your ATM and Credit Cards at home, and to try as much as possible to use them only for emergencies. Carrying ATMs and credit cards makes it easier for people to make unplanned purchases – POS machines even makes it faster, as you can pay conveniently without going to queue at the ATM gallery or have a rethink.

Even when in the times of emergency spending, be sure to look for deals and discounts you can trust, so as to cut the spending. If you are a business man that frequently goes on emergencies trips, look for hotel deals and discounts on Jumia Travel.

What ways have you devised to strive in the present economic situation? Share them with me below.

Established in March 2013, JarusHub is a Nigerian information hub with focus on career and management. It is rated Nigeria's most authoritative destination for online career resources. It parades an array of Nigerian professionals who share their career experiences with a view to bridging career information gap and mentoring a generation to success. JarusHub has revolutionised career information and experience sharing in Africa. Whether you're a student, a recent graduate or an established professional, or even an executive, you will always find something to learn on JarusHub. All enquiries to jarushub@gmail.com or 0808 540 4500. Facebook: www.facebook.com/jarushub; Twitter: @jarushub or @mcjarus.

Attend JarusHub’s 2024 Seplat Assessment Center Coaching

October 29, 2024

Let us have your say by leaving a comment belowCancel reply

Recommended For You

-

COMPANY REVIEW: TOTAL EXPLORATION AND PRODUCTION LIMITED

April 9, 2018 -

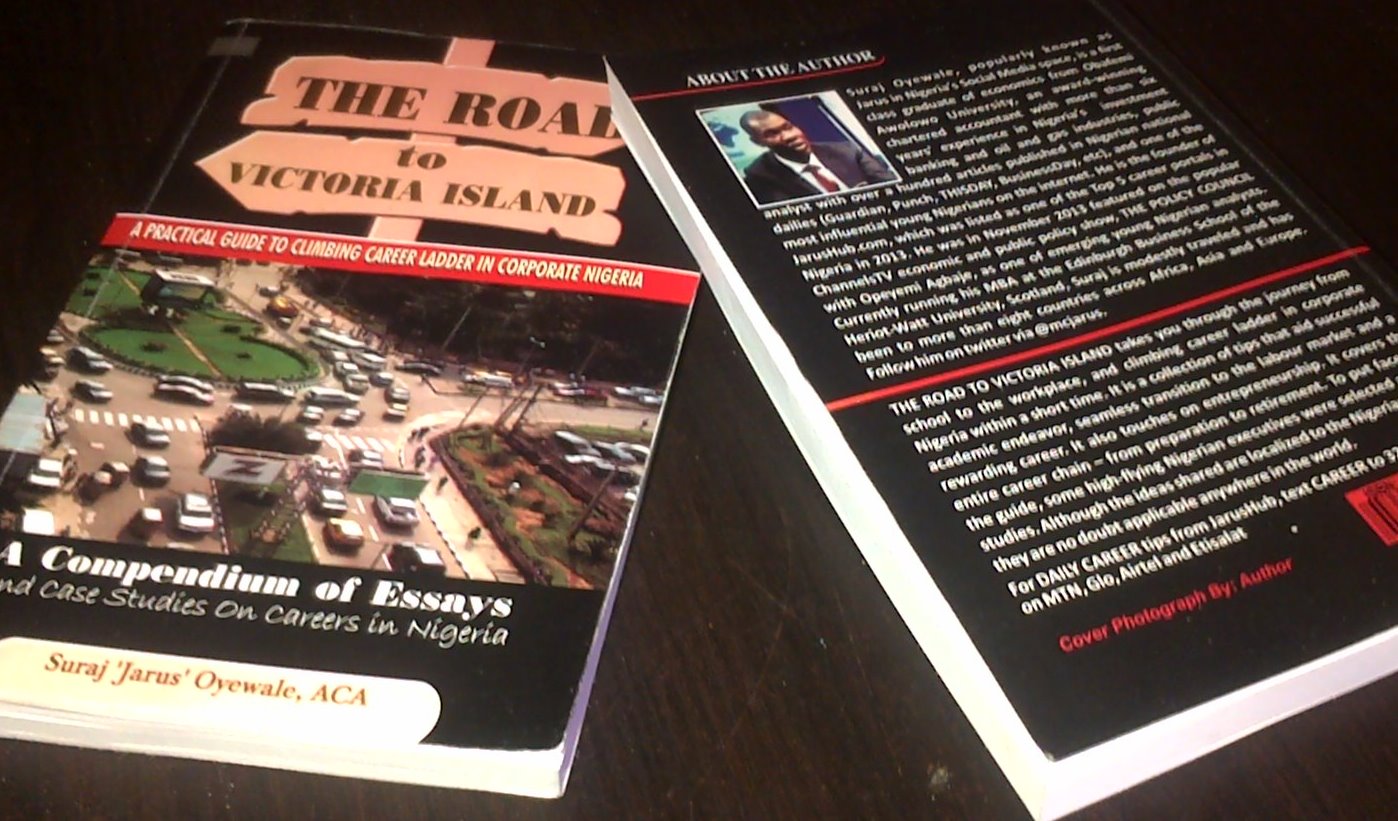

CAREER GUIDE: The Road to Victoria Island

November 22, 2015